How Your Medicare Insurance Plan Pays for Your Home Health Care Services

How Your Medicare Insurance Plan Pays for Your Home Health Care Services

Once a patient has completed a hospital stay or life-changing surgical operation, medical staff may recommend home health care services to ease the transition from the point of discharge from the hospital to where the patient is expected to independently function at home.

Home health care includes any prescribed healthcare assistance provided by clinicians who come into your home to tend to your medical, rehabilitative, and house management needs.

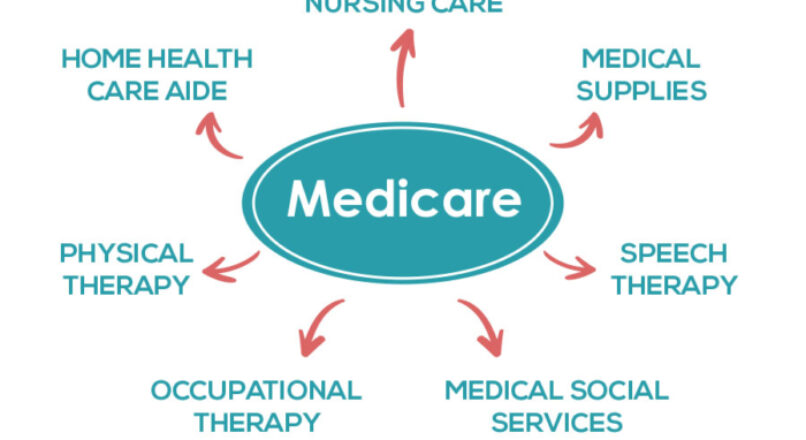

Services may include social work, nursing, physical therapy, occupational therapy, speech therapy, respiratory therapy, home health aides and other services that are deemed medically necessary to help an individual thrive at home.

So, who pays for home health care? We know that with rising healthcare costs that patients paying for services out-of-pocket can be expensive and impractical. Depending on your unique situation, certain medical insurances can provide partial or full coverage for home health care services.

In this article, we are going to specifically talk about Medicare, what home health care services are covered and not covered by Medicare, what patients are expected to pay out-of-pocket, what a notice of non-coverage is, and what to do if you feel services are ending too soon.

What’s the Difference Between The Original Medicare and Medicare Advantage Insurance Plans?

First, figure out which Medicare plan you have. Original Medicare has plans broken down into parts: Part A, Part B, and Part D. Part A covers hospital stays and other specific skilled services, Part B covers medical equipment and home health care services, and Part D covers prescription medications.

Medicare Advantage plans cover these parts on a whole, whether partial or full coverage depending on the services and equipment needed.

What Home Health Care Services are Covered by Your Medicare Insurance?

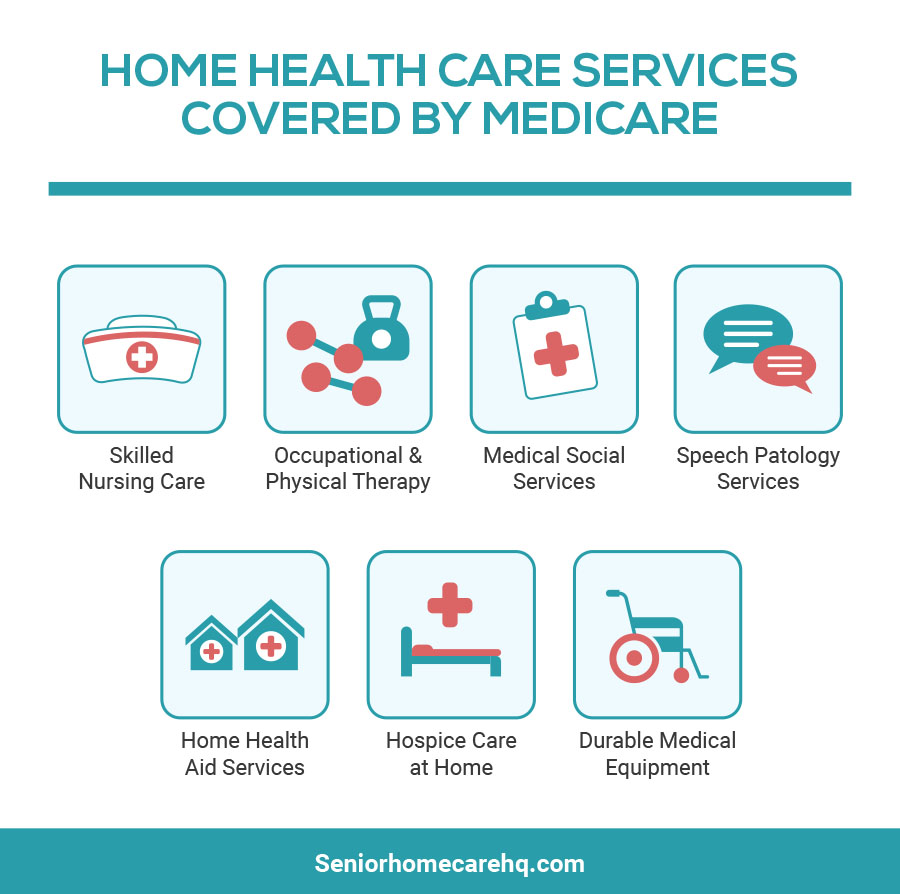

If services are deemed reasonable and medically necessary for you to recover, then Medicare (Part B) will cover the following services:

[su_service title=”Skilled Nursing Care” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]IV drug administration, medical injections, tube feedings, dressing changes, prescriptive drug education, or any services that must be performed by a licensed or registered nurse.

[su_service title=”Rehabilitation Services” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Physical, occupational, and/or speech therapy are provided for patients who need services to improve mobility and participation in daily living tasks.

[su_service title=”In-Home Health Aide Services” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Personnel who can assist with non-medical tasks including showers, dressing, feeding, and some household tasks.

[su_service title=”Social Services” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Social workers or counselors come in for social and emotional concerns as well as provide community resources.

[su_service title=”Medical Supplies” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]Medicare covers supplies like wound dressings. Durable Medical Equipment (DME) is also covered but billed separately, including wheelchairs, walkers, oxygen tanks, crutches, etc. DME is covered by Medicare Plan B.

[su_service title=”Prescription Drugs” icon=”icon: arrow-right” icon_color=”#25ff10″][/su_service]If your Medicare plan specifically covers prescription medication (Medicare Plan D), then you should be able to obtain partial to full coverage for specific drugs ordered by your primary doctor.

What Home Care Services Are Not Covered by Your Medicare Insurance?

Medicare does NOT cover the following regarding home health care services:

[su_service title=”24-Hour Care at Home” icon=”icon: remove” icon_color=”#cc270b”][/su_service] Nursing, rehabilitative, social, and in-home personnel are only present in the home for a designated number of hours per week, usually deemed by your doctor and what Medicare defines as medically necessary.

[su_service title=”Homemaker Services” icon=”icon: remove” icon_color=”#cc270b”][/su_service] Including laundry, cleaning, and running errands.

[su_service title=”Meal Delivery” icon=”icon: remove” icon_color=”#cc270b”][/su_service] Having meals delivered to your door.

[su_service title=”Custodial or Personal Care” icon=”icon: remove” icon_color=”#cc270b”][/su_service] This includes any non-medical help with personal care when it’s all you need (bathing, dressing, toileting, etc.)

[su_service title=”Limited Nursing Visits” icon=”icon: remove” icon_color=”#cc270b”][/su_service] For example, Medicare won’t cover a skilled nursing visit if it’s just for a blood draw.

[su_service title=”Adaptive Equipment” icon=”icon: remove” icon_color=”#cc270b”][/su_service] While Medicare has a dedicated section to coverage for durable medical equipment (DME), Medicare does not provide coverage for adaptive equipment (shower chairs, shoe horns, reachers, dressing, sticks, etc.)

What Home Care Services Are You Billed for or What Do You Pay Out of Pocket That Isn’t Covered By Your Medicare Insurance?

Before your home health care services begin, patients should be provided information about what to expect regarding bills and out-of-pocket expenses.

While some services are provided full coverage, some services including specific DME may only be covered up to 80% while the patient must pay 20% of the cost.

Patients will also be expected to pay the full cost of services that aren’t covered by Medicare as written in the insurance contract.

What is a Notice of Non-Coverage?

A Notice of Noncoverage, or an “Advance Beneficiary Notice of Noncoverage (ABN)”, is a notice issued to a patient that tells them about requested services that may not or will not be covered by Medicare. A few reasons why services may not be covered may include:

- The service isn’t medically necessary

- The patient doesn’t meet the criteria for home health care services

- The service is non-skilled

Patients need to receive this notice before home health care services begin to eliminate any surprise out-of-pocket costs.

What To Do If You Feel Your Home Health Care Services Are Ending Too Soon?

Your home health care agency should issue a notice at least a couple days in advance to tell you if your services are ending. If you do not receive this notice, ask for it.

The notice will include details such as why your services are ending and how to apply for a fast appeal if you believe your services are ending too soon.

During the process for a fast appeal, a Beneficiary and Family Centered Care Quality Improvement Organization (BFCC-QIO) reviews your case to determine if your home health care services need to be extended.

This organization will also ask the patient why they feel their services should continue, review their medical files, and talk to their primary physician.

In approximately 3 days, the BFCC-QIO should get back to you with their decision. If you do not seek a fast appeal when your services are about to end, then your home health care agency is required to send you a Notice of Noncoverage.

Where to File a Complaint About the Quality of Your Home Health Care Services That Are Covered by Your Medicare Insurance?

If you have a complaint about the quality of care or services you’re getting from a home health agency you hired, you should call either of these organizations:

- Your state home health hotline. Your home health agency should give you this number when you start getting home health services.

- The Beneficiary and Family Centered Care Quality Improvement Organization (BFCC-QIO) in your state. To get the phone number for your BFCC-QIO, visit Medicare.gov You can also call 1-800-MEDICARE.

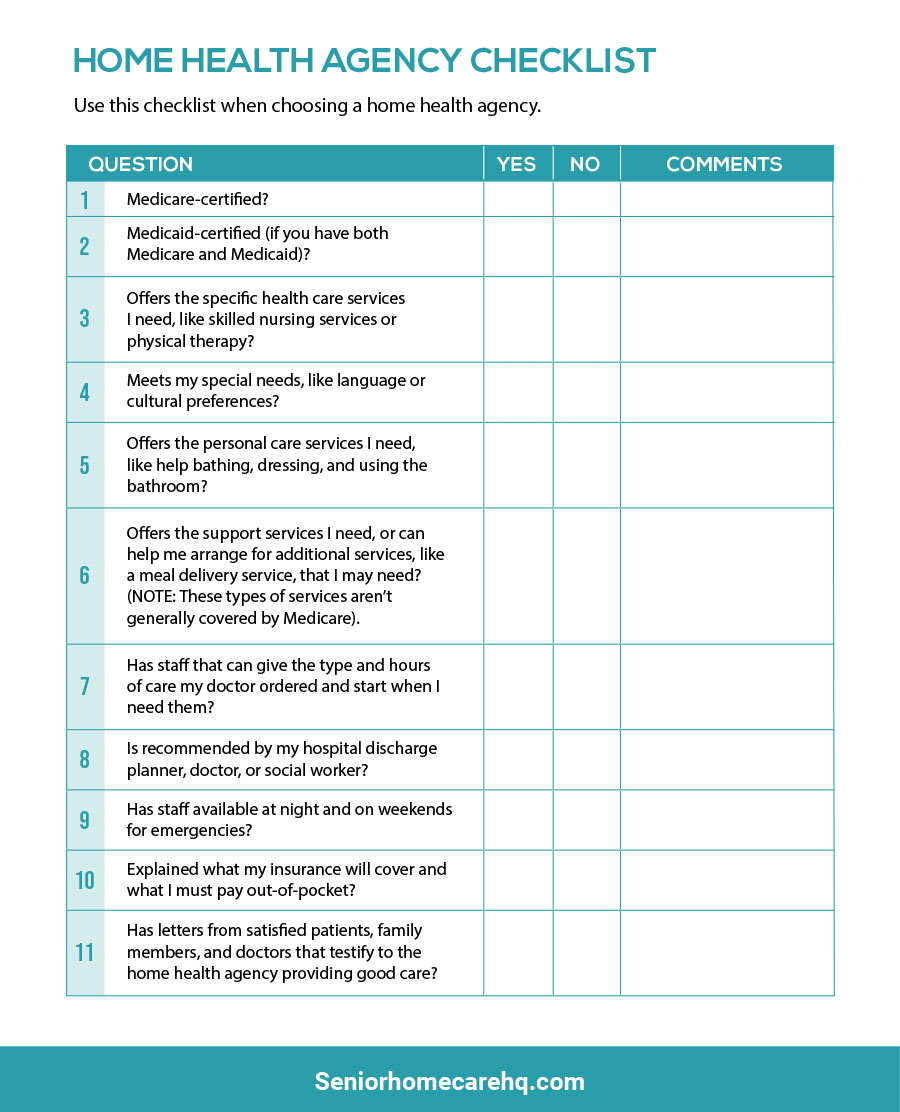

Use This Home Health Care Checklist To Find Your Next Home Health Care Service Provider

This checklist can help you (and your family or friends who are helping you) monitor your home health care. Use this checklist to help make sure that you’re getting good quality home health care.

A Few Tips On Your Home Health Care Services and Medicare Insurance Coverage

If you require home health care services and are new to the process, learn more about your current medical insurance plan and what will be covered.

Distinguish between Original Medicare and Medicare Advantage and figure out which one you have and the coverage available for your desired in-home services.

Stay in contact with your home health agency by making sure they issue you the right notices at the right time to prevent costly out-of-pocket payments. If you need more information, visit the Medicare website regarding home health care coverage.

Who Do You Contact If You Have Questions Or Need Help About Your Medicare Coverage And Home Health Care Services?

If you have questions about your Medicare home health care benefits or coverage and you have Original Medicare, visit Medicare.gov, or call 1-800-MEDICARE (1-800-633-4227).

If you get your Medicare benefits through a Medicare Advantage Plan (Part C) or other Medicare health plan, call your plan. You may also call the State Health Insurance Assistance Program (SHIP).

SHIP counselors answer questions about Medicare’s home health benefits and what Medicare, Medicaid, and other types of insurance pay for. To get the phone number for your SHIP, visit shiptacenter.org or call 1-800-MEDICARE.

FAQs

#1 Question: Who qualifies for home health care services?

Answer: You’re homebound, and a doctor certifies that you’re homebound. To be homebound means: You have trouble leaving your home without help (like using a cane, wheelchair, walker, or crutches; special transportation; or help from another person) because of an illness or injury, or leaving your home isn’t recommended because of your condition. Also if you’re normally unable to leave your home, but if you do it requires a major effort.

#2 Question: What home health services are covered by Medicare?

Answer: Skilled Nursing Care, Physical therapy, Occupational Therapy, and Speech-Language Pathology Services. Also Home Health Aide Services, Medical Social Services and Medical Supplies.

#3 Question: What happens after you are referred for home health care services by your doctor?

Answer: You may being to choose an agency from the participating Medicare-certified home health agencies that serve your local area. Your hospital discharge planner or other referring agency should help and honor your choices. Keep in mind that your agency choice maybe limited by availability and your insurance coverage.

#4 Question: What is a Plan of Care and does your home health care service agency provide this?

Answer: A plan of care lists what kind of services and care you should get based on your medical and health condition. Your plan of care should include the services you will need by the home health care agency, the health professionals that will deliver these services, how often you will receive home care services, a visiting schedule, the medical equipment you will need and what results your doctor expects from your treatment. This is usually done by your home health care agency on the first visit.

#5 Question: Which is the best way to choose a Medicare Approved Home Care Service Agency?

Answer: Read this article on the 7 tips to finding a good Medicare Approved Home Health Care Agency

#6 Question: How long will Medicare pay for home health care?

Answer: Medicare will pay for home health care as long as you are eligible and meet certain conditions, such as requiring skilled nursing or therapy services, and being homebound. However, there is no specific time limit for how long Medicare will pay for home health care, as the length of coverage can vary depending on your individual needs and progress. It’s recommended to periodically review your care plan with your healthcare provider and home health agency to ensure that your care is still necessary and covered by Medicare.

Leave a reply